Scalping With MA And MACD

The combined method of moving

average (MA) and MACD indicators is often practiced by scalpers and daily

traders. Time frames for entry can be 1 hour (1-hour) or lower (30 minutes or

15 minutes), while the time frame for the trend direction is usually 1-hour,

4-hour (4-hour) or daily. This method is often used because MACD can run well

at all time frame trading.

Determining Trend Directions

For the scalper, the time frame of 1

hour and 4 hours is often used to determine the direction of the current trend

before determining the entry position at a lower time frame. The popular and

frequently used trend indicator is the Average Directional Index (ADX), but

because at low time frames the response of this indicator tends to be slow

(lagging), the scalper often uses the moving average.

To increase the sensitivity of

moving averages that are also lagging, an exponential moving average (EMA) type

is calculated by weighting at the final price. In practice, EMA is accurate

enough to show the direction of the current trend.

In the following GBP / USD 4-hour

example, the period EMA 55 is used as a trend detector tool. Rules:

• When the price moves above the

EMA-55 indicator curve, the price is considered uptrend move and the trader

will only look for a buy opportunity.

• Conversely, when the price is

under the EMA-55 curve, it is considered downtrend and the trader will only

look for sell opportunities.

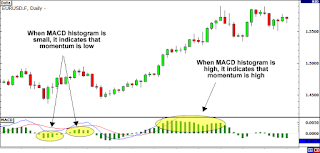

Determining the Momentum Entry

After knowing the position of the

desired entry, traders can determine the entry (timing) by looking at the MACD

indicator and OSMA histogram. Entry does not have to be on 4-hour time frame,

but can be at lower time frame according to trader's habit.

Buy if the MACD curve has crossed

the signal line from the bottom up and at the same time the OSMA histogram is

moving above the 0.00 level. Under these circumstances, uptrend momentum is

strong, and the wider the distance between the MACD curve and the signal line

the stronger the trend.

Exit when the MACD curve has cut the

signal line from top to bottom and at the same time the OSMA histogram is

moving below the 0.00 level. Under these conditions, uptrend momentum is

weakening and possibly the price will reverse direction.

For entry sell apply otherwise. Sell

when MACD cuts the signal line from top to bottom and OSMA moves below the 0.00

level. Then, exit if MACD cuts the signal line from bottom to top and OSMA

above level 0.00.

With this method the stop level can be determined rather tightly, and no matter how much risk / reward ratio is planned, the trader must exit when the trend's momentum has started to weaken.

No comments:

Post a Comment